4 years ago, in the first Being Proactive group I started, our goal was economical understand.

This included passive income, building profitable businesses, risk management, and investment. Back then I did a series of investments. It was in the middle of the financial crisis so it was a perfect opportunity to try out investing!

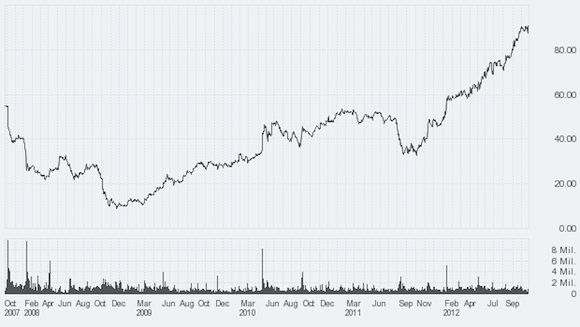

I am happy by the return I got. My stocks have gone up 300% in 4 years. It was based on simple value analysis.

Please be advised that I am far from a stock investor. I find it very unsatisfying as I feel I do not create anything. To me, it is just play for money, on a market driven by emotions. A simple way to diversify your surplus capital. I enjoy so much more to invest it in my own projects, and business ideas.

However, it is always great to learn a new skill! This is valued highly in Being Proactive. Investment certainly teaches you fundamentals in understanding if a business will do good, or not. I will lay down my simple layman rules here to show you how I did it.

Maybe you even want to try it out yourself!

In the long term, the market is going up!

The stock market always goes up in the long run. The world becomes richer as the population grows, technology advances is made, and new discoveries made among other things. So if you diversify well you will make a moderate gain.

This however is not advised if you actually want a good gain! This is just to give you an idea that when media speaks about the stock market being very negative you should not be afraid to invest. Actually you should invest much more then than any other time.

Do not be emotional about the money

Under no circumstances invest money that you cannot afford to lose. As soon as the money is invested you have to view this amount as lost. The money will never come back! When you are scared to lose money you do desperate decisions, and sell/buy at wrong times. You will buy when there is a lot of hype, and you will sell when there is a lot of negativity.

Find the real value of a business

Cut the drama of the stock market. You need ask yourself if a business is over- or undervalued. The way I look at it is, if a business have enough capital in themselves to continue, even if the investors does not believe in them, then it is great investment opportunity. (Of course the managing team, and company culture, is important things to take into account as well)

That is exactly why I am up so much after 4 years. 4 years ago investors was extremely negative about the companies regarding very meaningless drama.

I especially check for "hidden" assets such as property that can be sold if things go very bad.

Do the opposite of the market

This is a very simple rule, but you need to be careful. You should do the opposite of the market.

When the market is hyped (or bullish in investor term), be careful and maybe don't invest at all (or sell your existing investments). When the market is negative (bearish) it is the perfect opportunity to find undervalued businesses, and buy!

Of course you need to figure if a business actually has a good fundament, as markets will punish very hard the businesses that do not, and the business then might go bankrupt. If the business was/is run more on investor money than profits I would be very careful!